Why an ERC Loan could be the most effective Business determination You Make This yr

You’ve completed the investigate plus the function, you qualified for the worker Retention credit history, along with your refund is inside the pipeline. So where by’s the money your enterprise ought to thrive?

As you almost certainly know, it’s caught driving a wall of pink tape, made even worse by the latest slash-and-burn off staffing cuts to your IRS.

But here’s The excellent news: due to a rising number of ERC personal loan choices, you don’t should hold out. And dependant upon your plans, tapping into People resources at the moment may very well be the smartest fiscal final decision you make this yr.

precisely what is an ERC Loan?

An ERC loan is a funding Resolution that gives you early access to your pending worker Retention credit score. as opposed to ready months – or, in many instances, decades – for your IRS to course of action your refund, A personal funding spouse can progress nearly all of your expected credit history quantity quickly, often in just as very little as a couple of days.

The ERC bank loan is secured by your claim and compensated back when the IRS disburses your true money. And once you spouse with ERTC Funding, we take care of the tricky areas, like obtaining an proper bank loan products and finding you connected with the funding that will ideal provide your business. We now have helped numerous smaller corporations locate the correct funding product to secure their ERC mortgage fast. We've connections with both equally significant and modest funders, and we understand how to get you The cash you’re entitled to speedily. This is certainly what we do, so allow us to set our connections to work for you.

Why Consider an ERC mortgage?

Let’s take a look at just some factors entrepreneurs are turning to ERC loans today:

1. speedy usage of Performing cash

With ongoing financial uncertainty, inflation, rising expenditures, probable trade wars looming and an ever-tightening business lending marketplace, looking forward to a refund can put pressure on your own day-to-working day functions. An ERC personal loan aids you keep ahead of costs, not driving them. once you get an ERC loan, you could put your cash to be just right for you now, indicating that it could be paying out dividends by the time the IRS catches up to your declare.

2. Seize Opportunities Now, Not Later

From selecting important workers to purchasing stock or tech, prospects don’t wait for IRS timelines. With ERC cash in hand, you'll be able to act if the time is right—not when the government gets all-around to it. In The existing uncertain marketplace problem, This could necessarily mean the distinction between producing a crucial retain the services of and missing out, or building an awesome cash financial commitment in a price tag That will not be available later on.

three. keep away from sophisticated, substantial-fascination credit score possibilities

just about every enterprise, no matter how very well-resourced, requirements credit to clean peaks and valleys in the profits cycle. lots of use traces of credit score, bank cards, or other innovations that will include superior interest charges and perhaps bigger risk. when compared with bank cards or service provider money advances, ERC financial loans are typically reduced-risk and much more Expense-productive, because you’re fundamentally borrowing versus dollars previously owed to you personally. lessen curiosity premiums necessarily mean decrease Over-all price of credit rating,

permitting you extra independence and much more lengthy-expression income flow.

In addition, not like regular loans, ERC loans (or buyouts) don’t require income projections or long-time period credit history record. acceptance is predicated on your own claim.

How corporations are making use of ERC resources right now:

having to pay off high priced debt

Hiring crucial expertise ahead of opponents do

Launching new merchandise lines or products and services

constructing Functioning money reserves

Reinvesting in buyer acquisition

4. No need to have to surrender Equity

Some firms flip to fairness funding to smooth cash move uncertainty. having said that, as opposed to elevating funds as a result of buyers, ERC loans Allow you keep total ownership and control of your company. You won’t need to answer to investors or combat for control of the business enterprise you've created. increasing income via investors normally signifies providing up Manage or possession. With an ERC loan or buyout, you’re tapping into resources you’ve already attained, without the need of dilution or new associates.

in addition, several ERC lenders or funding companies don’t demand you to tackle personal debt in the normal perception. That’s a big earn to your equilibrium sheet.

A Bridge to Better Decisions

We often take a look at financial decisions as possibly “defensive” or “offensive.” The great thing about an ERC personal loan is the fact it supports equally:

Defensive: An ERC bank loan will smooth out your cash flow, enable you to reduce debt, and

defend your staff

Offensive: with the ERC financial loan, you'll be able to start internet marketing campaigns, up grade programs,

or prepare for expansion, all with a comparatively very low All round price of debt.

It’s not almost being afloat—it’s about positioning oneself to grow.

Who Can reward Most from an ERC mortgage?

companies in seasonal industries who require capital over the off-period, check here or who have to have a money infusion to prepare for busier times.

house owners facing IRS delays without apparent refund timeline who will use dollars to manage financial debt

firms that need to reinvest in operations or growth, Making the most of options because they occur up rather than expecting the cash flow approach to catch up.

business people who want to reduce monetary uncertainty and center on the business enterprise of business enterprise.

uncomplicated course of action, true Results

ERTC Funding is an expert Within this space, and our procedure is smooth, streamlined, and simple to

understand. frequently all you must convey to us is:

A filed ERC claim

Basic organization financials

evidence of IRS submission

Funding can occur in as very little as a week in the event you partner with ERTC Funding. in lieu of ready decades for your IRS, you are able to get pleasure from using your money shortly.

Take Charge of Your Timeline

There’s no reason to let IRS delays ascertain your small business approach. An ERC mortgage offers you the ability to move ahead now—on your own terms. no matter if you want to defend your margins or speed up your momentum, this kind of funding can present you with an actual edge.

Want to Explore your choices?

At ERTC Funding (ertcfunding.com), we make ERC financial loan possibilities very simple, rapidly, and tailored to your small business. in case you’d like to see what’s feasible, we’re pleased to walk you thru it. We may help you obtain the clarity you should move your small business ahead proficiently and effectively, now and Down the road.

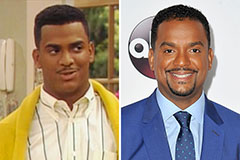

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!